4 common mistakes made with a 401(k) plan

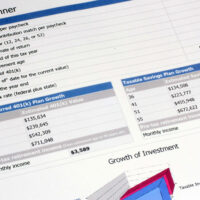

An employee might have various benefits during their tenure, such as the ability to contribute to a 401(k) plan—a retirement savings plan that offers tax advantages to savers. Depending on the type of 401(k) plan one picks, the individual may gain benefits such as a reduced taxable income. However, without the proper understanding of a 401(k) plan, one could make multiple mistakes that could affect an individual’s long-term savings. Switching jobs before becoming vested in a 401(k) While an employer might match funds in one’s 401(k) account, the employee is not eligible to keep the money until they are vested.

Read More